If employees must work from home and their employer does not reimburse certain costs, they may be entitled to claim tax relief. Understanding the rules for household expenses, business travel, and equipment purchases is key to making a successful claim.

Eligibility to claim tax relief applies when homeworking is a requirement of the role. This may be the case if an employee’s job necessitates living at a distance from the office, or if the employer does not maintain a physical office. Tax relief is generally not available where homeworking is a personal choice, even if permitted under the terms of the employment contract or where the office is occasionally at capacity.

Employees may claim a flat-rate tax relief of £6 per week to cover additional household costs incurred as a result of working from home, without the need to retain detailed expense records. The value of the relief depends on the individual’s highest marginal rate of tax.

For example, a basic-rate taxpayer (20%) would receive £1.20 per week in tax relief (20% of £6). Alternatively, individuals may opt to claim the actual additional costs incurred, provided they can supply evidence to HMRC in support of the claim.

Backdated claims for up to four previous tax years are also permitted.

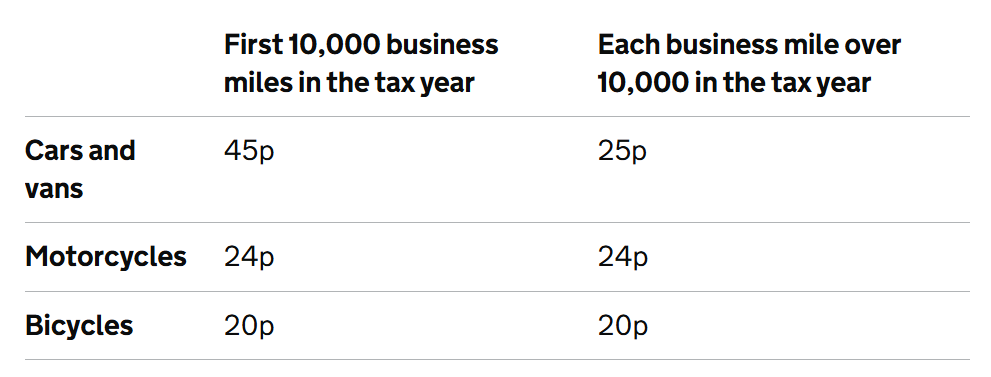

Tax relief may also be available for the use of a personal vehicle, a car, van, motorcycle, or bicycle, when used for business purposes. Relief is not available for ordinary commuting between home and a regular place of work. However, where travel is to a temporary workplace, or where the vehicle is used for other qualifying business journeys, tax relief may apply.

In addition, employees may claim tax relief on the cost of equipment purchased personally for work-related purposes, such as a laptop, office chair, or mobile phone, provided these are used exclusively or primarily for business use.

In more detail . . .

Working from home

You may be able to claim tax relief for additional household costs if you have to work at home for all or part of the week.

Who can claim tax relief

You can claim tax relief if you have to work from home, for example because:

- your employer does not have an office

- your job requires you to live far away from your office

Who cannot claim tax relief

You cannot claim tax relief if you choose to work from home. This includes if:

- your employment contract lets you work from home some or all of the time

- your employer has an office, but you cannot go there sometimes because it’s full

What you can claim for

You can only claim for things to do with your work, such as:

- business phone calls

- gas and electricity for your work area

You can claim for this tax year and the 4 previous tax years.

You cannot claim for things that you use for both private and business use, such as rent or broadband access.

How much you can claim

You can either claim tax relief on:

- £6 a week

- the exact amount you’ve spent

You’ll get tax relief based on the rate at which you pay tax.

Example

If you pay the 20% basic rate of tax and claim tax relief on £6 a week, you would get £1.20 per week in tax relief (20% of £6).

How to claim

When you claim, you must send evidence that you have to work from home if you’re either claiming:

- £6 a week for the tax year 2022 to 2023 or later

- the exact amount you’ve spent

If you’re claiming the exact amount you’ve spent, you will also need to send evidence such as a copy of your receipts or bills.

Uniforms, work clothing and tools

You may be able to claim tax relief on the cost of:

- cleaning, repairing or replacing a uniform or specialist clothing (for example, overalls or safety boots)

- repairing or replacing small tools you need to do your job (for example, scissors or an electric drill)

Claim relief for a uniform or specialist clothing

You can claim tax relief for a uniform. A uniform is a set of clothing that identifies you as having a certain occupation, for example nurse, or police officer.

You may also be able to claim for specialist clothing you need for work, even if it does not identify you as having a certain occupation, for example overalls or safety boots.

You cannot claim tax relief for:

- the initial cost of buying clothing for work

- cleaning, repairing or replacing everyday clothing you wear for work (even if you must wear a certain design or colour)

- the cost of laundering your own uniform or specialist clothing if your employer provides a free laundering service, and you choose not to use it

Personal Protective Equipment (PPE)

You cannot claim tax relief for PPE. If your job requires you to use PPE your employer should either:

- give you PPE free of charge

- ask you to buy it and reimburse you the costs

How much can you claim

You can either claim:

- the actual amount you’ve spent

- an agreed fixed amount (a ‘flat rate expense’ or ‘flat rate deduction’)

Check if your job has an agreed flat rate expense.

You can claim for the current tax year and the 4 previous tax years.

How to claim

If you claim the actual amount you’ve spent, you must:

- send copies of your receipts, or other evidence, which proves you’ve paid for the items

- claim these as ‘Other expenses’ within the service

If you claim an agreed fixed amount (a flat rate expense) you:

- do not need to send evidence

- claim these as ‘Uniform, work clothing and tools’ within the service

Vehicles you use for work

You may be able to claim tax relief if you use cars, vans, motorcycles or bicycles for work.

This does not include travelling to and from your work, unless it’s a temporary place of work.

How much you can claim depends on whether you’re using:

- a vehicle that you’ve bought or leased with your own money

- a vehicle owned or leased by your employer (a company vehicle)

You can claim for the current tax year and the 4 previous tax years, if you’re eligible.

Using your own vehicle for work

If you use your own vehicle or vehicles for work, you may be able to claim tax relief on the approved mileage rate. This covers the cost of owning and running your vehicle. You cannot claim separately for things like:

- fuel

- electricity

- vehicle tax

- MOTs

- repairs

To work out how much you can claim for each tax year you’ll need to:

- keep records of the dates and mileage of your work journeys

- add up the mileage for each vehicle type you’ve used for work

- take away any amount your employer pays you towards your costs, (sometimes called a ‘mileage allowance’)

Approved mileage rates

Using a company car for business

You can claim tax relief on the money you’ve spent on fuel and electricity, for business trips in your company car. Keep records to show the actual cost of the fuel.

If your employer reimburses some of the money, you can claim relief on the difference.

How to claim

When you claim, you must send HM Revenue and Customs (HMRC) copies of your mileage logs. These logs must include::

- the reason for every journey

- the postcode for the start point of every journey

- the postcode for the end point of every journey

If you are claiming for more than one employment, you must send a copy of your mileage log for each.

Professional fees and subscriptions

You can claim tax relief on:

- annual subscriptions you pay to approved professional bodies or learned societies if being a member of that body or society is relevant to your job

- professional membership fees, if you must pay the fees to be able to do your job

You cannot claim tax relief on life membership subscriptions, or for professional membership fees or annual subscriptions you:

- have not paid yourself (for example if your employer has paid for them)

- have paid to professional organisations that are not approved by HMRC

Your organisation can tell you how much tax you’re allowed to claim back.

You can claim for the current tax year and the 4 previous tax years.

How to claim

When you claim, you must send copies of receipts, or other evidence, that show how much you paid for each professional fee or subscription.

Travel and overnight expenses

If you have to travel for your work you may be able to claim tax relief on the cost or money you’ve spent on food or overnight expenses.

You cannot claim for travelling to and from work, unless you’re travelling to a temporary place of work.

You can claim tax relief for money you’ve spent on things like:

- public transport costs

- hotel accommodation if you have to stay overnight

- food and drink

- congestion charges and tolls

- parking fees

- business phone calls and printing costs

You may also be able to claim tax relief on business mileage.

You can claim for the current tax year and the 4 previous tax years.

How to claim

If you claim hotel and meal expenses, you’ll need to send receipts that include the date of your stay or of the meal and the name of the hotel or restaurant.