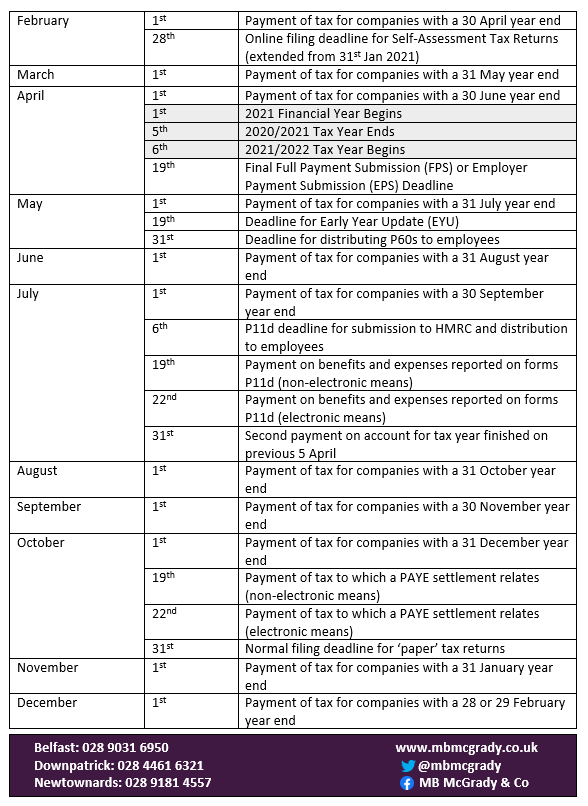

Key financial dates for your 2021 diary:

1st February

- Payment of tax for companies with a 30 April year end

28th February

- Online filing deadline for Self-Assessment Tax Returns (extended from 31st Jan 2021)

1st March

- Payment of tax for companies with a 31 May year end

1st April

- 2021 Financial Year Begins

- Payment of tax for companies with a 30 June year end

5th April

- 2020/2021 Tax Year Ends

6th April

- 2021/2022 Tax Year Begins

19th April

- Final Full Payment Submission (FPS) or Employer Payment Submission (EPS) Deadline

1st May

- Payment of tax for companies with a 31 July year end

19th May

- Deadline for Early Year Update (EYU)

31st May

- Deadline for distributing P60s to employees

1st June

- Payment of tax for companies with a 31 August year end

1st July

- Payment of tax for companies with a 30 September year end

6th July

- P11d deadline for submission to HMRC and distribution to employees

19th July

- Payment on benefits and expenses reported on forms P11d (non-electronic means)

22nd July

- Payment on benefits and expenses reported on forms P11d (electronic means)

31st July

- Second payment on account for tax year finished on previous 5 April

1st August

- Payment of tax for companies with a 31 October year end

1st September

- Payment of tax for companies with a 30 November year end

1st October

- Payment of tax for companies with a 31 December year end

19th October

- Payment of tax to which a PAYE settlement relates (non-electronic means)

22nd October

- Payment of tax to which a PAYE settlement relates (electronic means)

31st October

- Normal filing deadline for ‘paper’ tax returns

1st November

- Payment of tax for companies with a 31 January year end

1st December

- Payment of tax for companies with a 28 or 29 February year end